A credit card statement showing a charge at a steakhouse doesn't prove you had a deductible business meal. It only proves you paid for something. That distinction matters and it's one the IRS takes seriously during audits. Under IRC §274(d), travel and meal expenses require specific substantiation before they qualify as deductions. Without proper documentation, even legitimate business expenses can be disallowed, resulting in additional taxes, interest, and potential penalties.

The Five Elements You Must Document

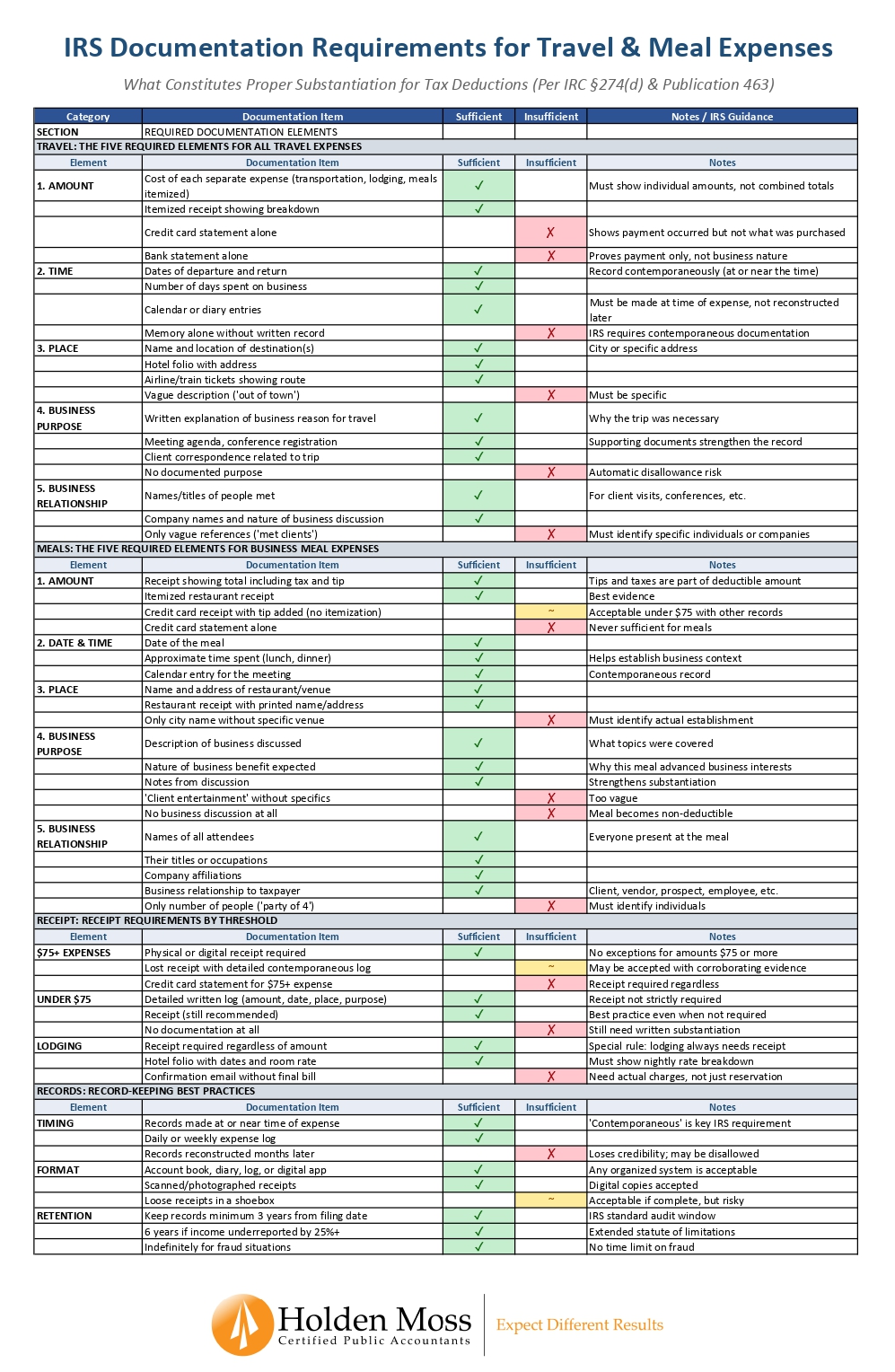

For every travel and meal expense, the IRS requires documentation of five specific elements: the amount (itemized, not just a total), the date and time, the place (specific venue, not just a city), the business purpose (why this expense was necessary), and the business relationship (who was involved and their connection to your business). Miss any of these, and your deduction is vulnerable.

What Counts as Proper Documentation

Proper substantiation means keeping itemized receipts along with a written record—an expense log, diary, or app—that captures the who, what, when, where, and why. For meals, you need the names of everyone present, their business relationship to you, and a description of the business topics discussed. Writing "client lunch" on a receipt isn't enough; you need to identify the actual client and what you talked about.

The $75 Threshold and Its Exceptions

The IRS doesn't strictly require receipts for expenses under $75—but this doesn't mean no documentation. You still need a detailed written record of every element. And there's an important exception: lodging always requires a receipt regardless of amount. That $50 roadside motel still needs a folio showing the nightly rate and dates of stay.

Timing Matters: The Contemporaneous Requirement

The IRS places significant weight on records made "at or near the time" of the expense. A detailed log created the same day carries far more credibility than one reconstructed months later from memory and bank statements. Build the habit of documenting expenses daily or weekly—waiting until year-end to piece things together invites scrutiny and potential disallowance.

Common Documentation Mistakes

We frequently see these documentation gaps during tax preparation and audit defense:

Relying on credit card statements alone – proves payment, not business purpose

Missing attendee names – "party of 4" doesn't identify the business contacts

Vague purpose descriptions – "business development" lacks specificity

No record of topics discussed – meals without documented business conversation may be disallowed entirely

Reconstructed records – documentation created long after the fact loses credibility

Setting Up Your Accounting System

Beyond documentation, your chart of accounts should separate expenses by deductibility level. With 2026 OBBBA changes creating three tiers for both meals and travel (100%, 50%, and 0% deductible), having distinct GL accounts for each category simplifies year-end reporting and ensures accurate tax calculations. This structure also makes it easier to identify documentation gaps before they become audit issues.

Our Documentation Checklist

We've created a comprehensive reference guide detailing exactly what the IRS considers sufficient versus insufficient documentation for travel and meal expenses.

Download the IRS Documentation Requirements for Travel & Meal Expenses file here.